Europol announced today that the Spain and Columbia collectively arrested 23 members of an unidentified transnational criminal organization (the “Group”) involved in laundering the proceeds of crime on behalf of other unidentified transitional criminal organizations. The Group didn’t launder a lot of money – only €2 million. The Group allegedly used Bitcoin to launder funds and part of the law enforcement action involved orders to freeze Bitcoin wallet addresses in Spain. The wallet addresses were set up in Spain for Columbian drug traffickers. According to Europol, drug traffickers used Bitcoin to hide the origin and movement of funds. However, since they and the wallet addresses were located and the subject of what appears to be mareva orders, it’s fairly evident that Bitcoin financial transactions can reveal the identity of the transactors, as well as the transactions.

23 members of transnational criminal organization arrested for money laundering

清华大学计划将区块链技术应用于文物保护

By Tongtong Xu

作为中国最高学府之一的清华大学日前递交了一项关于将区块链技术应用于文物保护的专利申请。

根据在4月递交,今天得到披露的专利,三位教员一同研发了一个区块链技术的系统概念,目的是储存并分享有重要意义的文物的数字版本。作为发明者的谭嘉嘉(音译)和陆小步(音译)向大家解释了这个系统的两个重要组成部分。

第一部分包括一个可以对重要文物进行扫描的3D计算模型,目的是在扫描之后能为储存提供一个数字范围的表格。在第二步中,该系统将每一项物品的数据通过一个叫做“Hashing”的加密过程自动储存在私有区块链上。

尽管专利申请并没有直接解释关于他们会如何开发该私有区块链的各方细节,发明者表明说初阶段的探索已在去年四月腾讯发布的区块链平台上进行测试。

See the full patent application below:

US indicts 12 Russian nationals for money laundering and hacking

The US has indicted 12 Russian foreign nationals for hacking, conspiracy and money laundering for allegedly interfering with the 2016 US presidential election. According to the indictment, Russia operated an intelligence agency called GRU which obtained confidential documents from the Clinton campaign systems by hacking and systematically released them to sway public opinion. According to the Indictment, the Russian hackers spoofed computers with fake Google emails to obtain access to computer emails and databases containing documents related to Hilliary Clinton and her presidential campaign.

The hackers, in what they believed was a move to avoid detection, used Bitcoin and the same Bitcoin wallet address to rent a server in Malaysia, register domain names and pay for other services. In total, they are alleged to have laundered $95,000 worth of Bitcoin in furtherance of their hacking activities. They also mined Bitcoin from their computers in order to pay for services. Unlike cash and other types of financial transactions, Bitcoin can be traced backwards online, even with tumblers and such, for financial crime purposes, and unlike traditional financial transactions, the identity of the owner of a Bitcoin wallet can also be determined.

Do foreign digital currency exchanges taking US customers online have to be AML registered in the US?

Do foreign digital currency exchanges that take US customers online have to be AML registered in the US?

Not unsurprisingly, the answer is yes.

Under US law, digital currency exchangers qualify as money transmitters and are subject to the obligations under the Bank Secrecy Act. Key concepts to know are that:

- An exchanger is a person engaged in the business of exchanging digital currencies for real money or other digital currencies.

- And if an exchanger, e.g., a business, accepts and transmits or buys or sells convertible digital currencies, it is a money transmitter under the regulations issued by FinCEN.

- If the exchange accepts but does not transmit, it is not a money transmitter.

- If you are a money transmitter, you must then comply with the Bank Secrecy Act and the registration obligations of FinCEN.

If you are a foreign digital currency exchange, you must register in the US if you onboard US customers whether F2F or Non F2F, who are located in the US even if none of your agents, agencies, branches or offices are physically located in the US.

Is “I don’t know where the online customer is from” a defense?

There are sometimes arguments made that a digital currency exchange that operates online may not know if it is onboarding US customers because the Non F2F online registration process involves providing an email address only.

That argument is problematic for an exchange because it evidences that the exchange has no anti-money laundering law, counter-terrorist financing or sanctions law compliance in place to identify its customers. If you do not know where your customer is from, how do you know they are not from a prohibited country? If you do not know who your customer is, how do you know they are not on a list of terrorists?

Moreover, all exchanges record and track IP addresses that provide the location of a customer when onboarding, and they know where each customer is visiting from. If an exchange does not, there are serious gaps at the exchange because it is conducting financial transactions without visibility, posing a threat to the financial system, the whole country and its bank. Such an exchange’s activities would make it aligned with the conduct of BTC-E and subject it to signifiant fines (see below).

Obligations for foreign exchanges taking US customers

So what then, are the obligations required for foreign digital currency exchanges that take US customers online from another country?

They must:

- Register with FinCEN;

- In whatever state you accept customers online, you must then register, usually as a money services business, with that state;

- Comply with the Bank Secrecy Act obligations including having a competent anti-money laundering program that is risk-based, report transactions including suspicious transactions, verify the identity of customers, undertake record keeping, appoint an AML compliance officer, train and audit the exchange’s systems and the AML program.

- Appoint a US agent for legal service who is physically located in the US.

In practice, the obligations require the digital currency exchange to verify customer identity, conduct due diligence on its customers, file reports with the federal government, and create and maintain records pursuant to the Bank Secrecy Act.

Banking de-risking over AML failures

Unfortunately, foreign digital currency exchanges that operate without authorization in the US by taking on US customers sometimes don’t realize that if they want to become registered and lawful in the future, that conduct harms them. That is because the registration process requires an exchange to disclose past unlawful operations or business practices that are inconsistent with the law. Foreign exchanges accepting US customers without registration in the US is an unlawful activity that is disclosable.

And then there is a greater risk to a digital currency exchange, which is the risk of being de-risked by its bank, or never getting banking services because they are deemed to be too risky for a bank. A foreign digital currency exchange that operates unlawfully in the US by taking US customers without being AML registered and processes financial transactions:

- exposes the bank to massive fines by US bank regulators;

- exposes the bank directors and officers to fines and criminal penalties;

- demonstrates that it is not compliant with AML / CTF and sanctions law; and

- breaches the terms and conditions of the contract for services it has with its bank.

No bank CEO will want to go to jail in the US for banking a digital currency exchange that is risky and does not comply with the law, and no CAMLO will expose the executives of a bank to that possibility.

Financial institutions and banks are beginning to ask for third party certifications that digital currency exchanges operate within the law and that for all the countries in which they accept clients, they are authorized and registered to do so by the applicable government agencies.

I think they should do more and require officers of digital currency exchanges to file periodic certifications to the bank confirming legal compliance, as well as filing third party AML certifications. They are the only two ways banks can be protected and minimize risks when they provide services to digital currency exchanges. An exchange can have a compliance plan but the bank has no confirmation that compliance has been operationalized at a digital currency exchange unless it obtains external professional certifications. Banks obtain legal protection by being able to rely upon the two certifications.

Banks are also asking for third party legal sign offs in respect of ICOs that digital currency exchanges list to confirm that the ICOs were launched legally and are not inconsistent with the securities legislation – both in terms of the ICO itself and the exchange’s function as a listing platform and what they are seeking is confirmation by legal counsel that the ICO was legally issued and that the exchange is registered with the requisite securities commission to trade that particular ICO.

Penalties

Foreign digital currency exchanges taking US customers are as liable as US exchanges for violations of US law. Last year, the US issued a civil penalty against BTC-E for US$110 million for willful violations of US anti-money laundering law and assessed a penalty of US$12 million against one of its administrators. What BTC-E did for Non F2F online onboarding was to obtain a username, a password and an e-mail address and once it had those, it conducted financial transactions by accepting digital currencies and fiat. Anti-money laundering law requires that exchanges conduct know you customer procedures at the account opening and onboarding phase, before a financial transaction, not after. There is no such thing as customer exit KYC – KYC is a customer entrance obligation.

A willful violation would arise when a foreign digital currency exchange does not inform itself about US law or engages unqualified persons for AML law. For example, a foreign digital currency exchange has legal advice, internal or external in respect of US law and ignores the legal advice, although that is arguably more than willful – it is knowingly unlawful.

A foreign person employed at or controlling a digital currency exchange that is convicted of money laundering can face up to 20 years in prison and fines of millions of dollars. Any property involved in a transaction or traceable to the proceeds of the criminal activity, including property and bank accounts (even if some of the money in the account is legitimate), may be subject to forfeiture.

Compliance also requires that digital currency exchanges investigate financial crimes and when warranted, file suspicious activity reports. Failures by companies to investigate financial crime alerts and to submit SARs, have resulted in penalties of up to US$97 million by the US government.

Liability can often be personal as well, as against compliance officers who fail to comply with anti-money laundering law at their companies. Liability has never attached, however, in cases where the CAMLO’s function is underfunded or not funded, or there is no buy-in or support from the directors for a compliance department, although CAMLO’s are expected to resign in those situations. Regulators recognize that there are instances where a CAMLO is appointed and the appointment is for show only, meaning that there is no desire or resources allocated by the company for a CAMLO to be an operational position. CAMLOs are also expected to file a report when they resign over a failure of the compliance function at their company.

The chart below, from Thomson Reuters, provides some interesting cases of personal liability of CAMLOs.

International money laundering case allegedly involving the ICO Dragon Coin

According to the federal Thai police, as reported here in the Bangkok Post, the Dragon Coin (which is an ICO), was used for or was involved in it seems unwittingly, an international fraud and money laundering scheme. The Dragon Coin is an ICO allegedly launched with the involvement of a former Triad boss and money launderer named Broken Tooth (reported here by the South China Morning Post). The real name of Broken Tooth is Wan Kuok-koi.

According to the Thai authorities, a man from Finland, Aarni Saarimaa, sent over 5,500 Bitcoin to invest in certain projects and part of the investment involved an investment in Dragon Coin. Saarimaa appears not to have used a third party escrow agent and the Bitcoin was allegedly diverted to seven Bitcoin wallets belonging to fraudsters who used some of it to buy land in Thailand. The rest was cashed out of a digital currency exchange (it is not known which exchange) and then transferred to 51 bank accounts held in the names of the alleged fraudsters. The bank accounts were frozen in Thailand but no action has been taken to freeze the Bitcoin wallets at the digital currency exchange.

An ICO is an initial coin offering meaning the issuance of a new digital currency that trades on certain digital currency exchanges. The Dragon Coin raised US$320 million from investors. According to a media report, Broken Tooth has moved on to develop a second Blockchain project in Cambodia whose purpose will be to offer services to casinos and promote Chinese culture. Since his release from jail for financial crimes and organized crime activities, Broken Tooth has become the chairman of The World Hongmen History and Culture Association, which connects Chinese foreign nationals internationally for business purposes.

Bitcoin programmer and seller indicted in US for money laundering

A Bitcoin seller was arrested in the US on Friday and charged with 31 offences including international money laundering, operating an illegal digital currency exchange, failing to have an anti-money laundering program in place and structuring transactions.

21-year-old Jacob Campos was a developer at Edge Wallet and a Bitcoin trader who sold Bitcoin in the US for 5% commission. He was a small player with a business that traded $900,000 in total, completed 971 transactions and had 900 customers. According to the indictment, he used US bank accounts to sell Bitcoin on behalf of clients without being registered with FinCEN as a money transmitting business.

According to the indictment, Campos had an account at the digital currency exchange Bitfinex during the time when Bitfinex had a bank account in Taiwan. Wells Fargo, the correspondent of Bitfinex’s former bank in Taiwan, indirectly derisked Bitfinex’s account as the correspondent. Bitfinex is believed to be a New York based digital currency exchange, with a corporate registered office in Hong Kong. Campos opened an account with Bitfinex, according to the indictment, after his account was derisked by Coinbase, another US based digital currency exchange.

Campos is a citizen of three countries and was held without bail after his arrest. His Facebook account is here and his Instagram account is here.

Another Canadian in Bitcoin ecosystem, who was the 3rd largest fentanyl dealer, targeted by US in Operation Darkness Falls

Operation Darkness Falls nets Canadian fentanyl dealer

The US DoJ, Department of Homeland Security, the FBI, the US Postal Service and DEA announced several arrests in Operation Darkness Falls, an international operation that sought to ferret out the identities of people selling illegal drugs, especially fentanyl, on the darknet that accepted Bitcoin and other digital currencies for payment.

A Canadian named Robert Kiessling was arrested in Canada. He was vendor DF44 on AlphaBay, the Canadian-owned darknet trading platform that facilitated the sale and purchase of illegal drugs, guns, weapons, stolen identities and such, using Bitcoin and other digital currencies.

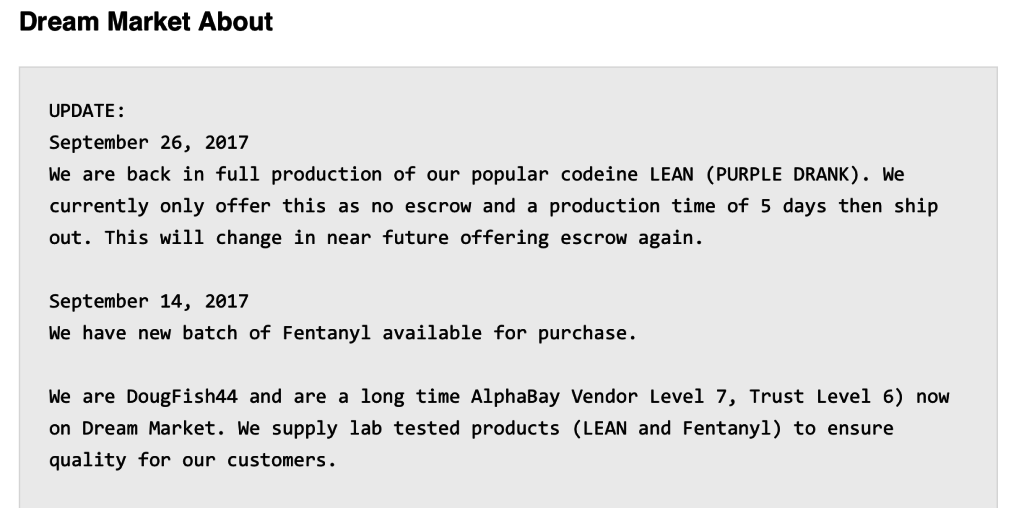

When AlphaBay was shut down by the US government, Kiessling moved to Dream Market. Under DF44, he openly promoted the sale of fentanyl (below). Kiessling committed suicide after his arrest before he could be extradited to the US. He was the 3rd largest fentanyl vendor in North America.

Largest fentanyl vendor also arrested in US

Also arrested were Matthew Roberts and Holly Roberts of San Antonio, Texas, who are alleged to have created and operated several darknet accounts, including MH4Life on Dream Market, Silk Road and on Canada’s AlphaBay to sell fentanyl, heroin, cocaine, marijuana, LSD, meth and other illegal drugs.

The Roberts are alleged to be the most prolific darknet fentanyl vendor in the US and the 4th largest in the world.

MH4Life seems to have known his identity was discovered on the darknet because he posted a “Code Red” post before being arrested (below).

Also arrested as part of Operation Darkness Falls were Americans Antoin Austin, known as Dark King 22, who pleaded guilty to operating a fentanyl business from an apartment with children and Ryan Kluth, known as Panachecak, who pleaded guilty to selling fentanyl and child pornography on the darknet. They both used Bitcoin for payment.

Warning from Jeff Sessions that he will “put you in jail” if you facilitate the fentanyl crisis killing Americans

US Attorney General, Jeff Sessions, held the press conference announcing Operation Darkness Falls and he specifically sent a “warning” to, inter alia, “foreign nationals” and foreign companies, including CEOs, that if they put profits over the lives of American citizens in the fentanyl crisis, he is coming after them and will “put you in jail” or “make you pay.”

The warning includes a warning to Canadians and Canadian companies, particularly Canadians in Vancouver.

That’s because the DEA has said on numerous occasions, including in the National Drug Threat Assessment, that fentanyl is coming into the US primarily from Canadians (Vancouver) who import it from China. Although fentanyl in the US also originates from Mexican cartels, according to the DEA, it is less desirable and less pure. Canadians buy fentanyl illegally from China using Bitcoin and other digital currencies so the DEA, FBI and DHS are mapping out those distribution channels to identify those in Canada involved in the fentanyl trade and those who trade or facilitate the trade of Bitcoin and other digital currencies for people in China and in Vancouver that fuel the fentanyl crisis.

Those in Canada who import fentanyl from China destined for the US cannot do it without financial and other services and no doubt the AG will be following the money trail.

The DEA has said that fentanyl vendors in China prefer to get paid in Bitcoin using OTC Bitcoin traders. OTC Bitcoin traders are traders who buy and sell Bitcoin personally, usually without physical offices, who are not registered for anti-money laundering purposes. If the fentanyl trade is carried out from Vancouver, it would mean that there are OTC Bitcoin traders doing large cash transactions for Chinese foreign nationals in Vancouver.

Including news of the arrest of Canadian Robert Kiessling no doubt emphasized the message that Canadians are on notice. The fact that AlphaBay operated for so long in Canada without impediment and had Canadian bank accounts is likely a concern of US regulators.

Law enforcement officers reiterated that they are using all of their resources to infiltrate the darknet to identify and prosecute those involved in fentanyl trafficking using Bitcoin and digital currencies and those that facilitate them in whatever country they may be in, which means that digital currency exchanges around the world should be extra vigilant in applying and enforcing anti-money laundering law when on-boarding customers and monitoring transactions.

Another Bitcoin exchange owner murdered – Bitcoin exchange owner in Vancouver, Canada, identified by the police as a drug trafficker and member of organized crime, killed in Mexico

Another Bitcoin exchange owner murdered

A Bitcoin exchange owner, Giuseppe Bugge, was murdered in Guadalajara, Mexico, last week, possibly by a Mexican drug cartel. Bugge was ambushed by eight to ten men and over-killed with 140 bullets from AK-47 and AR-15 assault guns.

Bugge operated a Bitcoin exchange called GS Crypto Currency Ltd. in Vancouver, Canada, that provided OTC services for the sale and purchase of Bitcoin.

Violent robberies and the murder of digital currency exchange owners is up 100% in 2018, as it becomes more dangerous to be associated with Bitcoin exchanges. Bugge is the second digital currency exchange owner to be murdered in 2018 – the first was a Russian named Pavel Nyashin. Another Canadian digital currency exchange owner was held at gun point and robbed earlier this year. Digital currency exchange owners, and high profile exchange executives seem to be at the highest risk for thefts, violent home invasions and extortion attempts.

The Vancouver Police Department said that Bugge was associated with the Hells Angels, a transnational criminal organization; was involved in drug trafficking; and had a long history of fraud in British Columbia. An associate of Bugge’s, Alfredo Mayorga Gudino, was also shot in Mexico but was not killed. A woman, who was with them, was taken by the state prosecutor’s office for questioning.

Several years ago, Bugge operated a number of moving companies that were allegedly used to smuggle drugs into the US. In 2005, one of the drivers of his moving company was arrested by US law enforcement and pled guilty to smuggling illegal drugs from Canada to the US, stuffed in a sofa.

Prosecutor Raúl Sánchez Jiménez, from the State of Jalisco, Mexico, where Bugge was killed, is seeking information about Bugge from US law enforcement.

During a press conference, the prosecutor said that no one from the Bugge family in West Vancouver has claimed Bugge’s body and that the Mexican authorities are treating it as an organized crime matter.

If Bugge was killed by a Mexican drug cartel, it may have been by the CJNG because Bugge was on their turf. Guadalajara, Jalisco, is the home of the most powerful drug cartel in Mexico, the Cartel Jalisco Nueva Generación (meaning the new generation cartel of Jalisco) whose acronym is CJNG.

The leader of the CJNG is Nemesio Oseguera Cervantes, also known as El Mencho. El Mencho was a former state police officer. He is now the most wanted drug kingpin in the world with a bounty of US$6.5 million for his capture.

The CJNG is alleged to have amassed a fortune of US$20 billion.

The CJNG focusses on the production and export of synthetic drugs and have the lion’s share of the meth trade, with drug trafficking routes in several countries on six continents, controlling half of Mexico, including both coasts and both borders. The CJNG is known for being extra violent and, for example, stewing the bodies of murdered people in acid to eliminate identity evidence.

Jalisco has the highest number of disappearances in Mexico — topping 3,000 per year. There were 11,241 murders linked to transnational criminal organizations in Mexico in the first half of 2018.

In 2015, the CJNG was listed by the US Department of the Treasury’s OFAC as a Specially Designated Narcotics Trafficker pursuant to the Foreign Narcotics Kingpin Designation Act. The listing designation means that all the assets of the CJNG and its members (such as bank accounts, investments, homes, etc.) in the US or under the control of US persons or entities (such as accounts opened by Canadian banks that have a US presence, or Canadian entities operating in the US or that have US bank accounts) are frozen, and such persons and entities are prohibited from engaging in financial transactions with the CJNG or their members. Penalties for violations of sanctions include fines of up to US$5 million and imprisonment of up to 30 years.

Iran sues US over sanctions

The Islamic Republic of Iran is suing the US at the International Court of Justice (ICJ) over the US sanctions annouced on May 8, 2018. ICJ is the forum for the resolution of disputes among members of the Untied Nations.

Iran is claiming that the sanctions of May 8, 2018, violate the Treaty of Amity entered into by the two countries in 1955. The court application of Iran is unclearly drafted but it seems that Iran is seeking an injunction to prevent the further application of sanctions, as well as a declaration that the sanctions are illegal, and damages for the harm allegedly caused by the sanctions to Iranian foreign nationals. What Iran appears to want more immediately, is the ability to continue to acquire aircraft parts from the US and EU.

It may be an uphill battle for Iran to argue its case on the basis of the Treaty of Amity because it is inconsistent with its conduct. The Treaty covers, among other things, the protection of diplomatic relations and diplomats, as well as financial and commercial activities. The Iranian hostage crisis demonstrated that Iran had no intention of adhering to the Treaty. During the Iranian hostage crisis, 50 American diplomats, who were protected by the Treaty of Amity, were kidnapped from the US Embassy in Tehran, held hostage and some were severely mis-treated for 444 days. The US Embassy is Tehran is also protected by the Treaty of Amity. Despite that, it is occupied by the Iranian Revolutionary Guard. The Iranian judiciary does not appear to acknowledge or abide by the Treaty of Amity either – for example, in this case, they ruled that foreign nationals do not have the same rights as Iranians in commercial matters in Iran – a ruling which is inconsistent with the terms of the Treaty of Amity.

Even if the Treaty of Amity is held to be in force, its terms specifically allow the US to take all steps to maintain or restore peace and security and to protect international security. The imposition of sanctions against Iran was pursuant to executive power to preserve the international financial system for international security purposes.

And moreover, sanctions required to protect against the movement of proceeds of terrorist financing that may originate from Iran and are routinely moved through Dubai, are authorized by legalization from the United Nations and supersede the Treaty of Amity, even if it is in force.

And finally, if Iran has a dispute with the US in respect of sanctions pursuant to the JCPOA, it must use the dispute resolution mechanism in that agreement to resolve them.

US and China continue joint investigation into fentanyl trafficking

This week, US and Chinese law enforcement announced the continuation of a joint investigation into fentanyl production and trafficking with a view to tackle the problem through money laundering investigations to identify TCOs involved.

As part of the announcement, China said that on September 1, 2018, it banned two fentanyl variants. In February 2017, China banned carfentanyl.

The DHS said that 35 persons have been identified and are in custody (but not named) that are associated with fentanyl trafficking in this specific case. Officials from the city of Xingtai, China, were in New Orleans as part of the investigation and announcement.

Two years ago, a 14-member delegation from the DEA spent a week in China meeting with Narcotics Control Bureau and Public Security Bureau officials in China to train them on investigating money laundering activities that would reveal fentanyl sellers.

Fentanyl is 50 to 100 times stronger than morphine, has been linked to hundreds of overdoses and deaths in the US annually, and over a thousand deaths a year in Vancouver, Canada. Fentanyl is often mixed into heroin and drug purchasers often have no idea that they’re taking fentanyl.

Illicit fentanyl trafficked in the US comes from Canada, China and Mexico. Xingtai is a key city in China where fentanyl is manufactured. Vancouver is a key city in Canada where fentanyl is shipped to before heading to the US. Vancouver is important because Canada is known for its relaxed approach to financial crime investigations and prosecutions.

Fentanyl from China is often paid for with Bitcoin (see online ad below from Xingtai for the illegal sale and export of carfentanyl for payment in Bitcoin although the ad may be a plant because the price for a gram of carfentanyl is not $30 and no one is named “Judy” in China, for real or for cover).

Did Canada just seize enough carfentanil from an alleged drug dealer that could have been used to kill hundreds of millions of people?

Last fall, the police in Ontario arrested a person named Maisum Ansari who lives in the suburbs of Toronto, who had in his home approximately 42 kilograms of carfentanil, or a substance containing carfentanil.

42 kilograms of carfentanil is a massive amount and likely the largest seizure by law enforcement in the history of seizures of carfentanil. According to Europol, before the seizure in Canada, the largest single seizure of carfentanil was 440 grams seized in the UK in 2017.

Carfentanil is 100 times more potent than fentanyl. According to the AG of New Jersey, 45 kilograms of fentanyl is enough to kill 18 million people. A similar amount of carfentanil, at 100 times the potency of fentanyl, is enough to kill 100 times that number – which is somewhat less than 1.8 billion people, assuming it is of the same purity. And even if it is of a lesser purity, it is still enough to kill tens of millions of people. The purity in drug seizures typically ranges from 0.00034% to 0.13% carfentanil.

What a person in suburban Toronto was doing with that much carfentanil is unknown. And we also do not know where he got it from. There are no minimum doses of carfentanil that are known to be safe for humans. For the less potent fentanyl, the lethal dose is between 1-2 milligrams (which is similar to a few grains of salt).

Carfentani is a opioid sedative used for large animals, mostly elephants. It affects the central nervous system and depresses respiration. An overdose can cause respiratory arrest and death.

The amount of carfentanil seized in the home of Ansari suggests it may have been contemplated for terrorism-related purposes rather than drug trafficking because it’s simply too much volume. Carfentanil could be used by terrorists as a WMD and hence is a money laundering and terrorist financing concern under the FATF Recommendations for banks and the AML community who are tasked with safeguarding the financial system. Carfentanil is believed to have been used in Russia in 2002 in aerosol form to end a stand-off with hostages which resulted in the death of 117 people.

It’s not the first time Canadians have been identified as major players in the fentanyl and carfentanil trade – in late 2016, 50 million lethal doses of carfentanil were shipped to Canada from China, labelled as printer ink. Last month, the DHS, DoJ and FBI, among others, identified a Canadian man as the third largest fentanyl trafficker in North America. And Interpol issued an international wanted notice for a Polish gangster who was given immigration status in Canada named Wojciech Joseph Grzesiowski, wanted for trafficking fentanyl and carfentanil for the leading mafia organization, the Ndrangheta.

Europol and the European Monitoring Centre for Drugs and Drug Addiction reported that in 2017, 62 grams of carfentanil was seized in Vancouver, Canada, which originated in Hong Kong and transited through Germany.

Ansari was charged with 337 offenses related to possession of illegal guns and possession of carfentanil for the purposes of trafficking. Later arrested was Babar Ali, who is alleged to be connected to Ansari.

Carfentanil and fentanyl have been linked to a significant number of overdose deaths in the US and Canada. Carfentanil is added to mixtures of heroin and cocaine and sold on the street.

Carfentanil and other fentanyl-related compounds are a serious danger to public safety, first responders, postal service employees and forensic laboratory personnel. It is also a significant health risk to bank employees who handle cash.

Ansari is connected to Faisal Hussain, the man who killed two people and wounded thirteen others on July 22, 2018, in Toronto, using a semiautomatic gun.

Carfentanil is imported to Canada (usually Vancouver) from China illegally, paid for with Bitcoin, and then distributed to the US. More recently, it is believed that the CJNG in Mexico are pivoting into the fentanyl business because of the higher profit margins.

The World Health Organization just recently recommended that carfentanil be listed in the Single Convention on Narcotic Drugs.

Chemically, carfentanil is methyl 1-(2-phenylethyl)-4-[phenyl(propanoyl) amino]piperidine-4-carboxylate.

US indicts two Chinese foreign nationals for operating criminal enterprise, international money laundering and selling fentanyl

The US Attorney General, Jeff Sessions, announced the unsealing of a 43-count indictment against two foreign nationals from China for allegedly manufacturing, advertising, selling and shipping fentanyl, carfentanil and other deadly drugs to several countries including the US and Canada, which resulted in the deaths of American citizens. They are also charged with operating a criminal enterprise and money laundering.

The charges carry a term of life imprisonment because of the deaths of Americans attributable to their alleged importation of fentanyl.

Indicted were Fujing Zheng and his father Guanghua Zheng, from Shanghai, China.

The DHS, DEA, IRS, Postal Service and FBI worked on the case and reiterated at a news conference that the “DEA will relentlessly pursue anyone shipping deadly fentanyl to the US wherever they may be and bring them to justice.”

The DHS, DEA, IRS, Postal Service and FBI worked on the case and reiterated at a news conference that the “DEA will relentlessly pursue anyone shipping deadly fentanyl to the US wherever they may be and bring them to justice.”

The indictment alleges that the Zhengs used numerous companies, including Global United Biotechnology, Golden Chemicals, Golden RC, Cambridge Chemicals and Wonda Science to manufacture and distribute hundreds of controlled substances, including fentanyl and carfentanil and maintained numerous websites to advertise and sell illegal drugs in more than 35 languages, shipping over 16 tons of chemicals every month from its own laboratory. They also allegedly made and shipped K2 and spice, drugs that are of growing concern for overdose deaths.

The Zhengs are also alleged to have agreed to make potent anti-cancer drugs illegally and ship them to the US.

The Zhengs laundered the proceeds of crime using Bitcoin and Litecoin and cashed out into bank accounts in China and Hong Kong, including the China Merchants Bank in Hong Kong. Drug traffickers were asked to say wire transfers to the China Merchants Bank in Hong were for “tuition.”

According to the indictment, the Zhengs used a number of digital currency exchanges outside of China and wallets to receive proceeds of crime from foreign drug purchasers. They also frequently used Skrill to launder money and receive drug payments for fentanyl.

According to the indictment, they set up companies in the BVI, the jurisdiction favored for money laundering and tax evasions by wealthy Chinese foreign nationals.

Neither Zheng is in the US and once located, will have to be extradited to the US.

CEO of the exchange OKCoin allegedly stalked by several customers demanding back investments in digital currencies

According to Caixin, China’s most influential media company, the founder and CEO of the Chinese digital currency exchange OKCoin, Mingxing Xu, 徐明星, was stalked and chased to a hotel in Shanghai by angry customers of his exchange.

Later that day, he was taken to the Shanghai police station and detained overnight and part of the next day for questioning.

It is not clear whether he was held as a victim, a witness or as a possible defendant but another media organization in China reported that a criminal complaint was approved in connection with OkCoin but no one has confirmed this yet.

Apparently, several of the customers of OKCoin also went to the police station. According to some of the customers interviewed by Caixin, they were prevented from selling Bitcoin and other digital currencies online at OKCoin.

According to news reports, the police in China are investigating whether it is true that customers were prevented from selling. Exchanges, like brokerages, must follow customer instructions and complete a trade or they are liable for losses incurred by the delay and also like brokers, they are liable if an exchange refuses to return funds to the customer.

OKCoin operates in China and the US and is one of the largest exchanges in the world.

Two months ago, the founder of the ICO Skycoin, Brandon Smietana, was allegedly threatened, beat up, robbed and forcibly confined at his home in China for several hours by his own employees who forced him to transfer 18 Bitcoin to them.

New York AG releases integrity report on digital currency exchanges – its not that pretty

The New York Office of the Attorney General (the “OAG“) released a report yesterday on the integrity of digital currency exchanges. For the report, it sought the voluntary participation of exchanges including Bitstamp, Coinbase, Binance, Huobi, Bitfinex, Kraken, Bittrex, Gemini and Poloniex, among others. Interestingly, the OAG noted that Binance and Kraken declined to participate, citing the fact that they said that they do not allow trading from New York but the OAG found otherwise and referred them to the Department of Financial Services for potential violations of the law.

The key findings of the OAG report are not positive. It found that:

- Protection of customer funds are often non-existent or limited. The AG noted that digital currency exchanges lack audit standards and lack transparency and there is no independent auditing available of digital currencies allegedly in the possession of exchanges. The AG noted that customers are at risk of the unauthorized withdrawal of their funds and misappropriation.

- No safeguards exist at exchanges for integrity and surveillance of trading patterns.

- Owners and insiders of exchanges often trade on their own insider information and there is no conflict of interests protections.

- Some exchanges, such as Bitfinex, are not authorized to operate in the US and when it comes to anti-money laundering law, Bitfinex does not pursue AML law with onboarding and seeks only an email address to allow trading.

- With respect to sanctions and terrorist financing, exchanges usually use IP addresses to block certain countries but only Bitstamp and Poloniex used technology to combat VPNs to be able to confirm that it is not accepting financial transactions from prohibited countries.

- Most exchanges do not have bank accounts to allow fiat to digital currency trading.

- Some exchanges do not address manipulative or abusive trading activity.

- Exchanges do not have objective criteria with respect to listing ICOs for transparency and did not disclose the fees charged to list an ICO.

- Data security was not tested at a few exchanges, including Bitfinex and Tidex.

Iran using ghost supertankers to avoid sanctions law

According to this article in the Financial Times, Iran has sent a supertanker, called Happiness I, en route to Asia, carrying 2 million barrels of oil that is off-the-radar literally, in order to obfuscate that it is transporting Iranian oil to another country. When ships are off-radar, they turn off their transponders and are no longer broadcasting their positions.

Off-radar shipping by Iran is in response to the new US sanctions imposed against Iran that come into effect on November 5, 2018.

Although many EU nations appear to oppose the renewal of US sanctions against Iran, their opposition has little effect because oil sales involve the private sector (banks, law firms, insurance firms, refineries, accounting firms), and it is the private sector that needs access to US correspondent banks to survive. Engaging in commerce with Iran, including dealing with Iranian oil, is too much of a risk for the private sector. Even Turkey, which buys 7% of Iranian oil, decreased its purchases by 45%.

Officials are suggesting that the US government intends to ramp up sanctions enforcement against the private sector, mostly as against foreign banks with US correspondents or operations in the US which gives them jurisdiction, that facilitate sanctions avoidance involving Iran or Iranian foreign nationals.

Hezbollah financier arrested for laundering $10 million at casino

An alleged financier for Hezbollah, Assad Ahmad Barakat, was arrested in Brazil, accused of laundering $10 million at a casino in Argentina. In 2004, the US Treasury said Barakat was one of the most influential members of Hezbollah, a listed terrorist organization. It accused him of using his businesses in the border areas of Brazil, Paraguay and Argentina as a front for fundraising for Hezbollah as well as coercing local shopkeepers into giving money to the organization. Barakat is on the US sanctions list.

Paraguay has stated that it believes Barakat financed the 1994 attack in Buenos Aires that killed 85 people.

7 Russian foreign nationals indicted in US for alleged money laundering and hacking of Canadian / US agencies

The Department of Justice announced the indictment of 7 Russian foreign nationals in Pennsylvania for their roles in an alleged hacking of anti-doping sports agencies, including one in Canada called the Canadian Centre for Ethics and Sports. According to the indictment, the indicted persons hacked into computers for several years to allegedly influence sports doping and used Bitcoin to facilitate the payment of domain names and to use servers. According to the indictment, the defendants hacked into computers remotely from Moscow and also hacked into agency computers and mobile devices by gaining access to hotel and airport wifi networks. The defendants allegedly traveled to Brazil and Switzerland to hack hotel wifi networks to obtain log in credentials, and once they had access, they conducted large-scale exports of data. The indictment also alleges that the defendants acquired Bitcoin from mining, which offers a way to acquire Bitcoin relatively anonymously because the only connection point (and therefore identifying point), is the IP address.

You can read more here.

ICOs & tokens increasingly attracting FBI criminal attention

According to this interview with FBI’s Financial Crimes Section Chief on CNBC, the FBI is seeing an increase in the number of complaints and cases opened involving digital currencies and crime. In particular, the FBI said that it is mostly ICOs and associated investment fraud schemes involving Bitcoin that are on the raise for investigations where retail investors (e.g., the public) is the target.

According to the FBI, criminals are increasingly using Bitcoin for crimes and as a result, the FBI is liaising with the Five Eyes to learn about digital currencies and crime. However, cash is still king for crimes because of the fact that there is always an intersection point when dealing with digital currencies.

FinCEN issues money laundering advisory for Iran’s use of Bitcoin and digital currencies

FinCEN has issued an advisory for Iran that specifically is targeted for digital currency exchanges, banks and foreign banks so that the latter can understand their obligations under the correspondent banking system. The advisory is interesting because it is one of first instances of an attempt to provide guidance to foreign banks in respect of the reach of US financial crime law arising from the correspondent banking system. Often foreign banks, and in particular, digital currency exchanges, are not aware of the correspondent banking system and how US AML / CTF / sanctions law is applicable to them.

The practice in Iran is to move money out to Dubai and from there, banks and money services businesses sanctions-strip the money and move it to the US, Germany, UK or Canada. Sanctions-stripping is a method of providing originating information for banks that strips the origin of the money from being associated with Iran.

The Advisory directs US correspondents to go back to foreign banks they provide services to (most Canadian banks) and seek additional information to ascertain that they are not being used for sanctions avoidance from Iran. In other words, to determine if sanctions-stripping of data occurred.

Here is a common example in Canada – an Iranian foreign national, almost always an undisclosed politically exposed person (“PEP“) immigrating to Canada opens a bank account in Dubai and wires money to that bank. The bank then wires it to a Quebec bank as part of a paid investor immigration program and strips out the originating information that the funds originated from Iran. The Dubai bank and the Quebec bank know the funds involve an Iranian foreign national (the latter because they administer investor immigration funds) but that information is not disclosed. The money moves through a US correspondent bank in New York as originating from Dubai. The US correspondent bank is unaware that it handled Iranian funds from a PEP that may be subject to US sanctions. The US correspondent bank is then exposed to potential criminal liability in the US for unknowingly dealing in funds from Iran.

According to the Advisory, officials tied to the Central Bank of Iran, in particular, are being deployed to move money internationally to finance terrorism through Dubai and other cities in the United Arab Emirates. The Advisory provides examples including of an Iranian airline that moved money to Canada through Germany to finance terrorism. All Iranian foreign nationals use third parties and third party countries to move money – they have to because it is near impossible to export money in any form from Iran directly to another foreign financial institution.

Except it is possible with Bitcoin and other digital currencies because they are decentralized and are outside of the formal financial system. The Advisory estimates that at least $3.8 million is exiting Iran through Bitcoin annually from Iranian and foreign digital currency exchanges and OTC trades (referred to sometimes as peer-to-peer).

And that brings us to so-called sovereign initial coin offerings (“SOV“) that are ICOs issued by a government. A SOV is a new digital currency issued off an existing or a new Blockchain by a government agency. Venezuela is an example of a country that issued a SOV called the Petro coin for sanctions avoidance on the NEM Blockchain, that can be bought with NEM coins. Here, you can read about how millions of dollars of stolen NEM coin were apparently OTC traded at a Vancouver digital currency exchange which means that the Petro coin from Venezuela issued for US sanctions avoidance, can be bought with NEM at a Vancouver digital currency exchange without visibility since that exchange trades NEM. If you can buy the Petro coin in Vancouver with NEM for sanctions avoidance, you will be able to buy an Iranian SOV.

Last month, Iran issued a notice that it was working on a SOV and the concern is that it will be used, like Venezuela, for sanctions avoidance.

The Advisory suggests that banks and foreign digital currency exchanges monitor IP addresses and engage in Blockchain tracing to ascertain the original of digital currency trades from Iran, although the latter is harder to do than the Advisory suggests. No Blockchain identifies the origination of a transaction – only IP tracing can do that and with Iran’s heavy use of VPNs country-wide, such tracing is difficult. You can, however, trace to Iranian wallets and that is where the focus should be on, in addition to utilizing solid AML, CTF and sanctions compliance methods. And in addition, banks and digital currency exchanges should know the typologies in respect of Iran — for example, the trades of digital currencies involving Iran in Canada typically take place involving former Iranians in Canada with a Canadian passport. That is because the movement of money to and from Iran is closely transacted among persons of Iranian origin and specifically those with a Canadian passport.

Oxymonster sentenced to 20 years for money laundering and dark net drug sales

A foreign national from France, known on the dark net as OxyMonster, was sentenced to 20 years jail in the US for selling drugs such as fentanyl, online, and laundering the proceeds of crime. Gal Vallerius, 36, pleaded guilty to drug distribution and money laundering in Miami in June for selling cocaine, methamphetamine, fentanyl, oxycodone and other drugs on Dream Market where he was paid in Bitcoin.

Vallerius was arrested in August 2017, entering the US to attend a beard contest. In addition to selling illegal drugs online, he admitted to being an administrator of Dream Market. Part of the way he was detected was through his Twitter and Instagram accounts and by tracing his Bitcoin wallet addresses to Local Bitcoins.

Dream Market is a marketplace accessible on TOR, which has a tumbler service built in so that it is not possible to trace Bitcoin payments from buyer and seller.

He was arrested with 99.98 in Bitcoin and 121.98 in Bitcoin Cash under his control which was seized.